Whether you're looking to grow through strategic acquisitions and alliances or maximize value through a divestiture, PMC Transactions is your trusted partner, guiding you every step of the way.

We leverage our industry expertise and global connections with our proprietary IT solutions to identify ideal targets on the buy-side or qualified investors on the sell-side, ensuring a successful outcome tailored to your vision.

Scroll down or skip to your area of interest:

Deal Sourcing - Our Specialty

Screening global markets for the right M&A targets, buyers, or investors is a full-time job – one that demands experience, connections, and data.

This responsibility often falls on business and corporate development teams already managing a full workload, making the process challenging.

Our goal is to optimize this search down to the last detail by leveraging expertise, extensive networks, and advanced in-house software solutions like IntelliSearch. These tools allow us to identify and source the most relevant opportunities, ensuring a perfect alignment with your strategic objectives.

“Years ago, Marc asked me to use my IT skills to help him take his business to the next level. I was reluctant - front-end development was not my core interest and what more could he ask for than a "boring" website? Partly out of goodwill towards my brother, I agreed to help. However, as I became more familiar with the industry, I quickly realized the immense potential of data superiority in our field, which was largely untapped due to the elaborate, specific development requirements and niche application of the resulting tools. We immediately seized the opportunity and have fully embraced this unusual synergy, positioning our company in a unique way to this day.”

Considering a partnership? Reach out for a confidential discussion:

Buy-Side

PMC Transactions: Expert partner for strategic and financial investors seeking to acquire assets and companies in the pharmaceutical and healthcare sectors.

Core Services:

Target Identification and Screening

Market Research: Analyzing target markets to identify potential acquisition opportunities.

Company Screening: Screening companies based on specific criteria (e.g., size, industry, financial performance).

Initial Due Diligence: Conducting preliminary due diligence to assess the target's viability.

Due Diligence

Financial Due Diligence: Analyzing financial statements, tax returns, and other financial data.

Legal Due Diligence: Assessing legal risks, contracts, and intellectual property.

Operational Due Diligence: Evaluating operational efficiency, management team, and supply chain.

Commercial Due Diligence: Analyzing the target's market position, customer relationships, and competitive landscape.

Deal Structuring and Negotiation

Deal Structure: Developing optimal deal structures (e.g., asset purchase, stock purchase, merger) to maximize value.

Valuation Analysis: Conducting detailed financial and strategic valuations to determine fair pricing.

Negotiation Strategy: Developing and executing a robust negotiation strategy to secure favorable terms.

Financing and Funding

Capital Raising: Assisting in securing the necessary financing for the acquisition.

Debt Financing: Negotiating favorable terms with lenders.

Equity Financing: Identifying and engaging potential equity investors.

Our core value is to provide you, our client, with maximum flexibility and agility in today's fast-moving markets. This commitment is best reflected in our partnering structure, which focuses on a continuous, long-term but modular relationship, giving you the opportunity to change gears by choosing your current level of involvement:

Envision the strategical benefit of a multi-year partnership with a concept scenario:

Your pace, your strategy – our buy-side model adapts seamlessly, whether you prefer a measured approach or a high-frequency deal flow. Below is a real-world case demonstrating our results in a high-intensity environment:

Considering a partnership? Reach out for a confidential discussion:

Sell-Side

PMC Transactions: Your trusted partner for the sale of pharmaceutical and healthcare assets or companies to strategic and institutional buyers.

Core Services:

Valuation and Strategic Positioning

Valuation Analysis: Conducting a comprehensive valuation of the company to determine its fair market value.

Marketing and Sales Process

Identify Potential Buyers: Identifying and targeting potential buyers who are strategically aligned with the company.

Confidential Information Memorandum (CIM): Preparing a high-quality CIM that highlights the company's key value propositions.

Marketing and Outreach: Developing and executing a targeted marketing campaign to reach potential buyers.

Managing the Sales Process: Organizing and managing the sales process, including setting up meetings, conducting presentations, and responding to inquiries.

Due Diligence Management

Prepare for Due Diligence: Coordinating the preparation of financial, legal, and operational due diligence materials.

Manage the Due Diligence Process: Facilitating the due diligence process by responding to information requests and addressing inquiries.

Negotiations and Deal Structuring

Negotiation Strategy: Developing and executing a robust negotiation strategy to maximize value.

Deal Structuring: Structuring the deal to optimize the outcome for the client, considering factors such as purchase price, payment terms, and conditions.

LOI, APA or SPA: Drafting and negotiating the LOI, APA or SPA, outlining the key terms and conditions of the transaction.

Closing the Deal

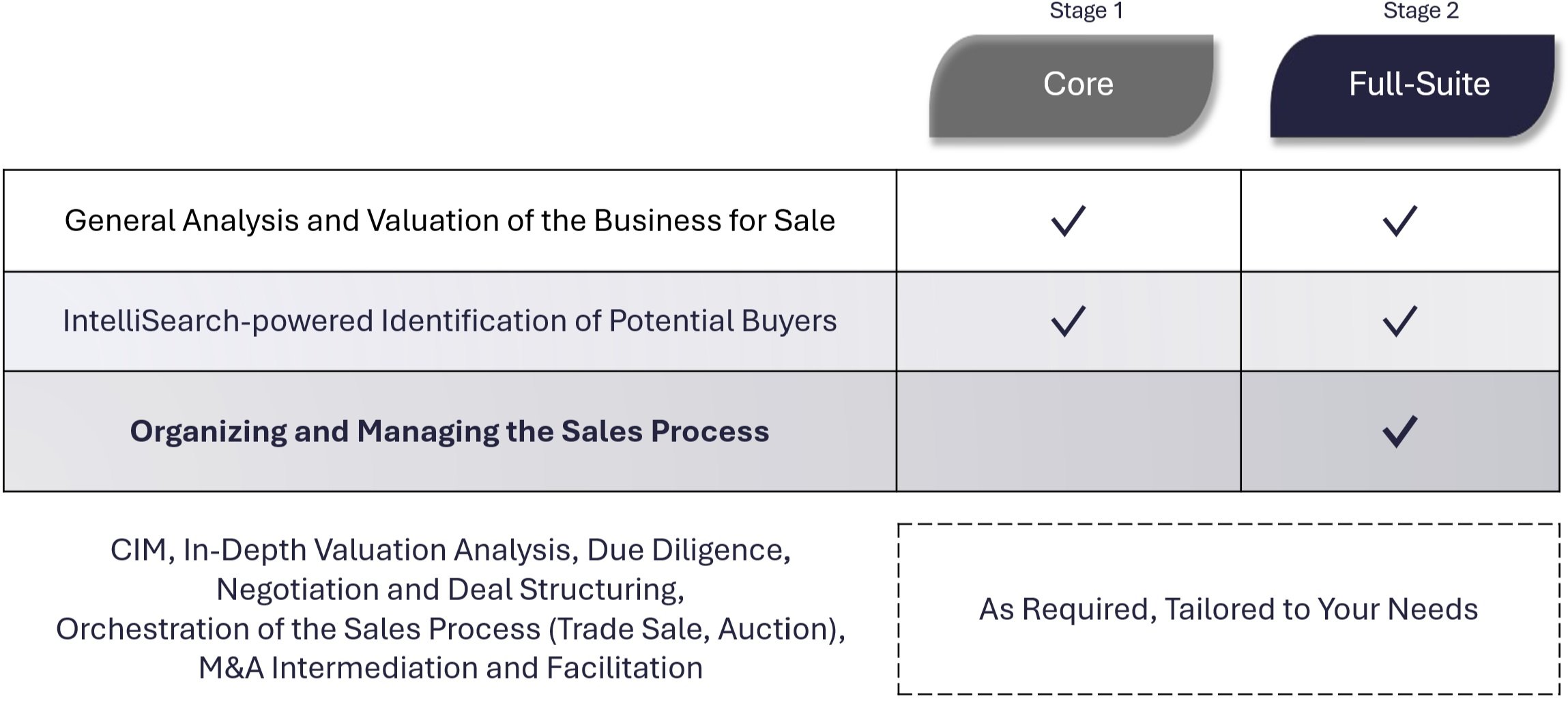

Recognising that every sales process is different, we strive for a perfect fit by offering you a customised and controllable level of sell-side involvement to have the most efficient impact on the process:

Considering a partnership? Reach out for a confidential discussion:

Gain Clarity: Accurate Valuations - Confident Transactions

PMC Transactions excels in industry-standard valuation methodologies, with in-depth experience in

Comparable Company Analysis (CCA/Comps)

Precedent Transactions Analysis

Discounted Cash Flow (DCF) Analysis

Net Present Value (NPV) Analysis